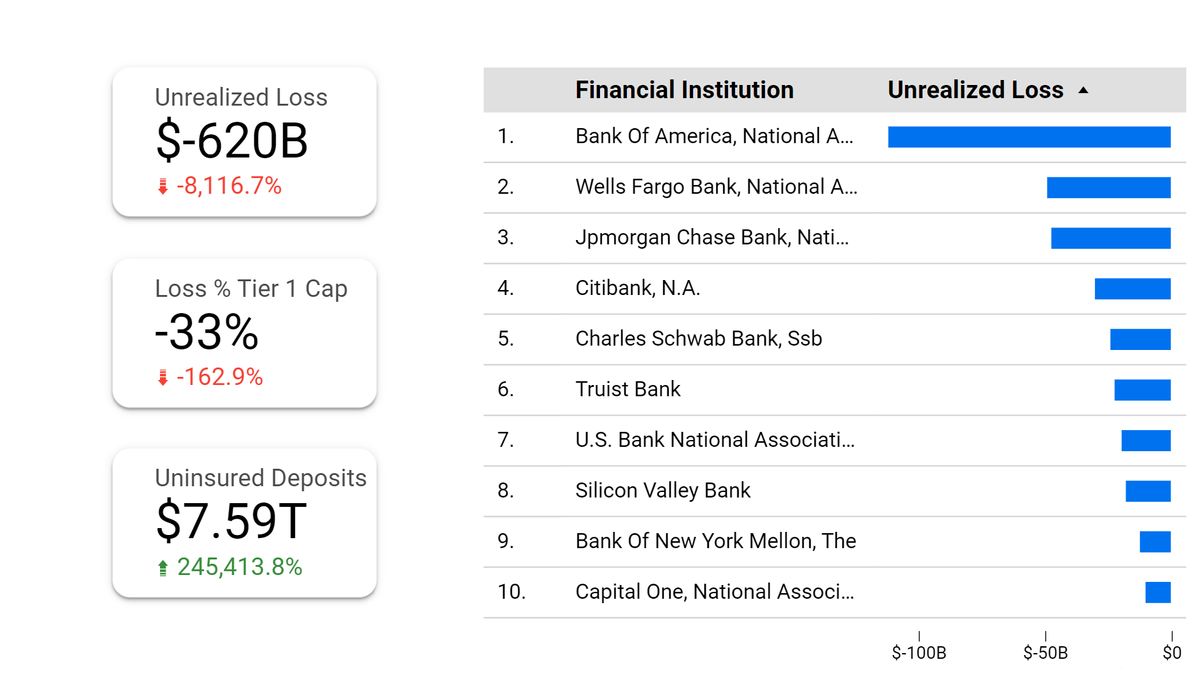

$620 billion in unrealized losses, reported by banks in 2022. Here is the breakdown.

Unrealized losses are losses that have not yet been realized by a bank. They can occur when the value of a bank's assets falls below their book value. This can happen due to a number of factors, such as a decline in interest rates, the collapse of a real estate market, or a recession.

As of December 31, 2022 there were 796 banks with unrealized losses greater than 10% of their respective tier 1 capital, and 61% in uninsured deposits, at risk of bank-runs, similar to Silicon Valley Bank, Signature Bank, and Silvergate Bank.

Unrealized losses can be a major problem for banks, as they can erode their capital and make it difficult for them to lend money. They can also lead to higher interest rates, as banks need to charge more to make up for the losses they are taking.

There are a number of things that banks can do to reduce their unrealized losses. One is to hold less risky assets. Another is to hedge against changes in interest rates. And finally, they can raise more capital.

Unrealized losses are a fact of life for banks. However, by taking steps to reduce them, banks can protect themselves from the risks they pose.

Here are some of the key risks associated with unrealized losses:

- Capital erosion: Unrealized losses can erode a bank's capital base, making it difficult for the bank to lend money.

- Higher interest rates: Banks may need to charge higher interest rates to make up for the losses they are taking, which can lead to higher borrowing costs for businesses and consumers.

- Liquidity problems: Unrealized losses can lead to liquidity problems for banks, as they may be forced to sell assets at a loss in order to meet their obligations.

- Reputational damage: Unrealized losses can damage a bank's reputation, as they may be seen as a sign of weakness or mismanagement.

Banks can take a number of steps to reduce their unrealized losses, including:

- Holding less risky assets: Banks can reduce their unrealized losses by holding less risky assets. This means investing in assets that are less likely to decline in value, such as government bonds.

- Hedging against changes in interest rates: Banks can hedge against changes in interest rates by using financial instruments such as interest rate swaps. This allows them to lock in the price of interest rates, which can help to protect them from losses if interest rates rise.

- Raising more capital: Banks can raise more capital to reduce their unrealized losses. This means selling more shares of stock or issuing more debt.

Unrealized losses can be a significant problem for banks, but there are a number of steps that banks can take to reduce them. By taking these steps, banks can protect themselves from the risks that unrealized losses pose.