3 Banks with $258 billion failed, sparking panic. Here are the facts.

On December 31, 2022 financial institutions reported $326B in unrealized losses, as a result of the Fed raising interest rates to lower inflation.

On March 8, 2023 Silicon Valley Bank ranked #21 by total deposits in the US, announced stock offerings to cover $1.8B in losses following the sale of $21B in treasury securities carried at loss, sparking a panic.

Signature Bank #32 and Silvergate Bank #202 followed, impacting 378K bank accounts, 83% with balances above $250K or $245B in uninsured deposits.

On March 12, 2023 joint statement by Treasury, Federal Reserve, and FDIC was released announcing the full protection of all depositors in Silicon Valley Bank and Signature Bank, to prevent further bank runs. The Federal Reserve Board also announced a new Bank Term Funding Program making $2T available in backstop funding, or up to $25B per depository institution to access liquidity without the need to sell securities at loss.

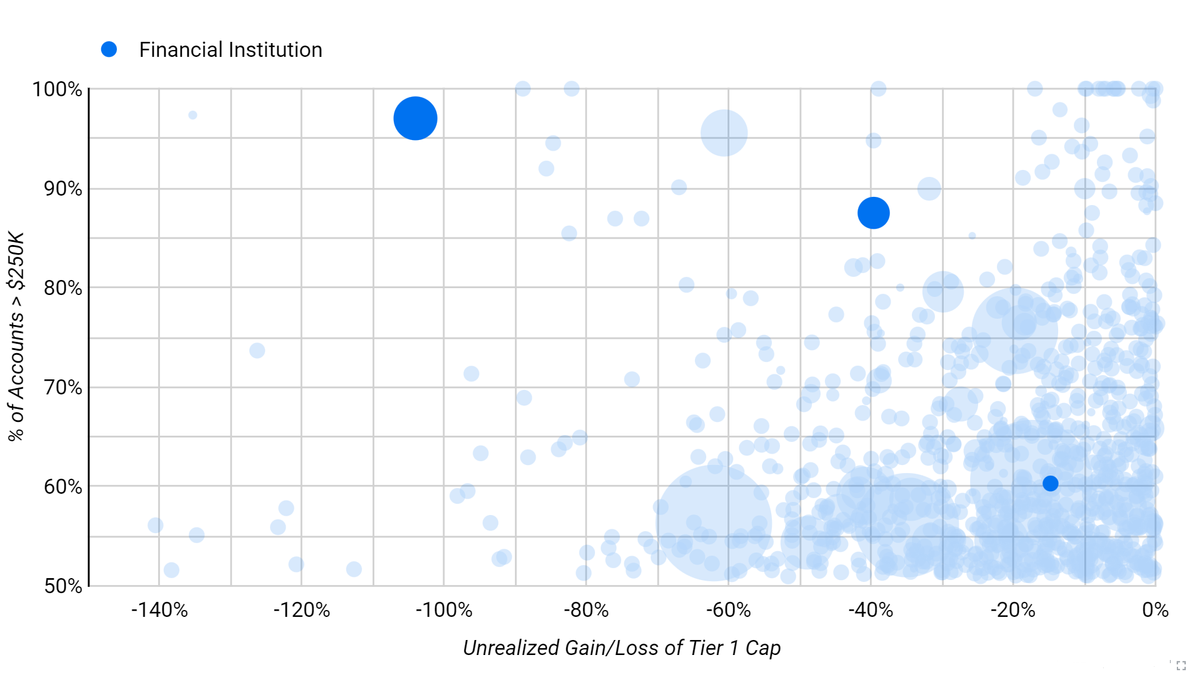

There are 796 financial institutions with 66% deposit market share, that have more than 50% in uninsured deposits and unrealized losses greater than 10% of their tier 1 capital ratio, carrying similar deposit flight risk. If materialized, it will result in withdrawal of $7.59T in uninsured deposits.

Bubble chart - Financial institutions with significant share of uninsured deposits and reported unrealized losses

Reference

- Dataset source - Federal Financial Institutions Examination Council's (FFIEC)

- % of Deposits > $250K - Percent of Deposits with balance greater than $250K - estimate of uninsured deposits

- $ of Accounts > $250K - Total amount of deposits with balance greater than $250K

- Unrealized Loss % of Tier 1 Capital - Unrealized net gains (losses) as a share of capital for loss absorption